Virginia State Tax Rebate 2023 – The Virginia State Tax Rebate is a program designed to provide financial relief to eligible taxpayers who have been impacted by the COVID-19 pandemic. The rebate will be issued in 2023, and taxpayers must apply by a specific deadline to receive the rebate.

Eligibility

To be eligible for the Virginia State Tax Rebate, taxpayers must meet certain requirements. These requirements may include:

- Being a resident of Virginia

- Filing a Virginia state income tax return for the taxable year

- Meeting certain income thresholds

- Being impacted by the COVID-19 pandemic

How to Apply

To apply for the Virginia State Tax Rebate, taxpayers will need to follow specific steps. These steps may include:

- Checking their eligibility on the Virginia Department of Taxation website

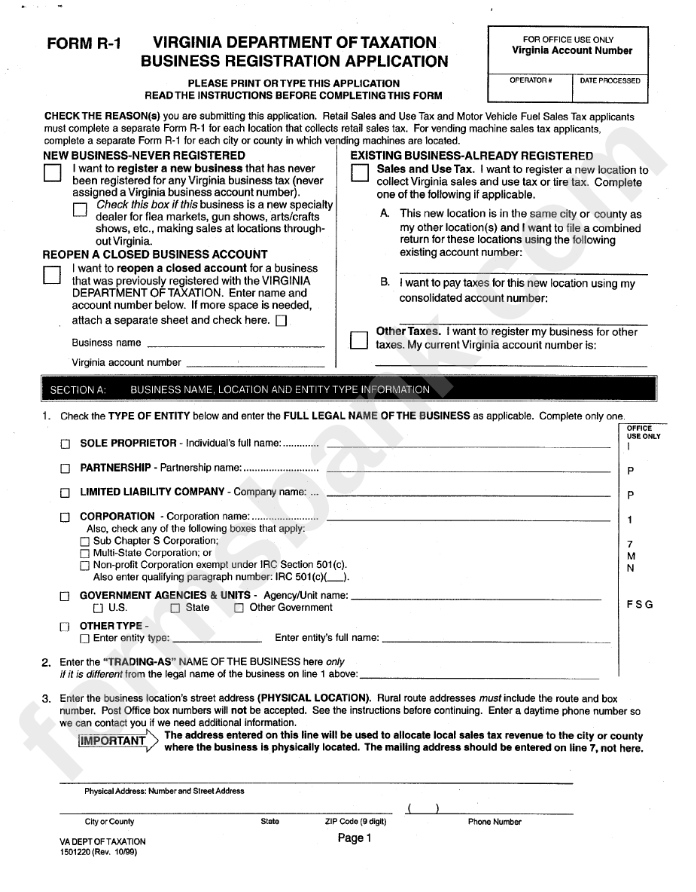

- Filling out the necessary forms and providing required documentation

- Submitting the application by the specified deadline

Deadline

Taxpayers must apply for the Virginia State Tax Rebate by a specific deadline to be eligible to receive the rebate. The deadline may vary from year to year and will be detailed on the Virginia Department of Taxation website.

Amount

The amount of the Virginia State Tax Rebate will depend on various factors, including the taxpayer’s income and the impact of the COVID-19 pandemic on their financial situation. The exact calculation method will be detailed on the Virginia Department of Taxation website.

Conclusion

The Virginia State Tax Rebate is a program designed to provide financial relief to eligible taxpayers impacted by the COVID-19 pandemic. Taxpayers who meet the eligibility requirements can apply for the rebate by following specific steps and submitting the application by the deadline. For more information, visit the Virginia Department of Taxation website.