Tax Rebate 2023 South Carolina – Welcome to an exclusive guide on how to take full advantage of the upcoming Tax Rebate in South Carolina for the year 2023. This article will provide you with comprehensive information and expert insights on how you can maximize your savings and navigate through the process seamlessly. South Carolina residents have a unique opportunity to benefit from this tax incentive, and we are here to help you make the most of it. Read on to discover everything you need to know about the Tax Rebate 2023 in South Carolina.

Understanding the Tax Rebate 2023

The Tax Rebate 2023 in South Carolina is a state initiative designed to provide financial relief and stimulate the local economy. It offers eligible individuals and families the chance to receive a refund on a portion of their tax payments, resulting in significant savings. The rebate is calculated based on various factors, including income, filing status, and the number of dependents.

To qualify for the Tax Rebate 2023, South Carolina residents must meet certain criteria established by the state government. These criteria typically involve income thresholds and residency requirements. It’s crucial to familiarize yourself with the specific eligibility criteria to ensure you can take advantage of this valuable opportunity.

Eligibility and Application Process

To determine your eligibility for the Tax Rebate 2023 in South Carolina, you need to meet the following requirements:

- Residency: You must be a legal resident of South Carolina during the tax year for which the rebate is being offered.

- Filing Status: The tax rebate eligibility is based on your filing status, including single, married filing jointly, head of household, etc.

- Income: Your income level should fall within the designated income brackets established by the state government.

- Dependents: The number of dependents you claim on your tax return may impact the amount of rebate you receive.

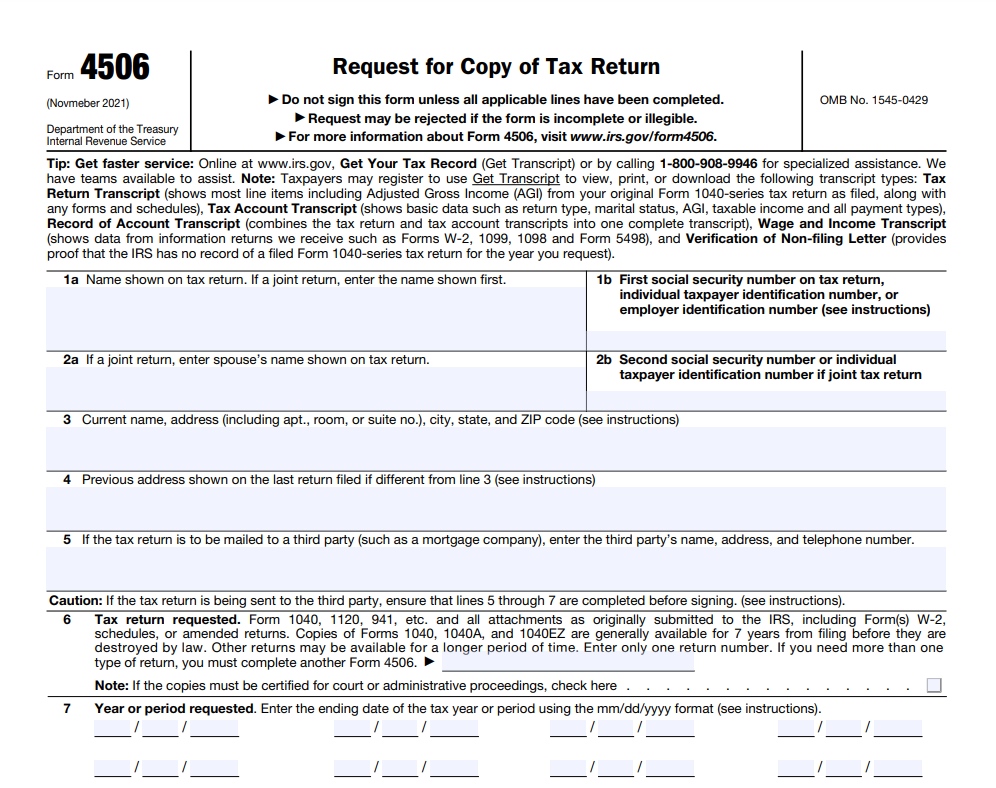

To apply for the Tax Rebate 2023, you will need to follow the standard tax filing process. Ensure that you accurately complete all the necessary forms, including any additional documentation required to support your eligibility. Filing electronically is generally recommended for faster processing and smoother communication with the tax authorities.

Maximizing Your Tax Savings

Now that you understand the basics of the Tax Rebate 2023 in South Carolina, it’s time to explore some strategies to maximize your tax savings:

- Claim All Eligible Deductions: Ensure you claim all applicable deductions and credits when filing your tax return. This includes deductions for mortgage interest, medical expenses, education expenses, and other eligible expenses. Consult with a qualified tax professional to determine which deductions apply to your specific situation.

- Contribute to Retirement Accounts: Consider contributing to retirement accounts such as a 401(k) or IRA. Contributions to these accounts can help reduce your taxable income, potentially increasing your tax rebate amount.

- Review Tax Withholdings: Review your tax withholdings throughout the year to ensure they accurately reflect your financial situation. Adjustments may be necessary to avoid overpaying or underpaying taxes and to optimize your tax rebate.

- Seek Professional Assistance: If you’re unsure about navigating the complexities of tax planning and maximizing your tax savings, seek guidance from a certified tax professional. They can provide personalized advice based on your specific circumstances and help you make the most of the Tax Rebate 2023.

The Benefits of Tax Rebate 2023

The Tax Rebate 2023 in South Carolina offers numerous benefits to eligible individuals and families:

- Financial Relief: The rebate provides a valuable opportunity to receive a refund on a portion of your tax payments, offering financial relief and potentially freeing up funds for other purposes.

- Stimulating the Local Economy: By putting money back into the hands of taxpayers, the Tax Rebate 2023 helps stimulate the local economy. Increased spending can have a positive impact on businesses and job creation in South Carolina.

Conclusion

The Tax Rebate 2023 in South Carolina is an excellent opportunity for residents to maximize their tax savings and gain financial relief. By understanding the eligibility criteria, following the proper application process, and implementing smart tax strategies, you can make the most of this valuable incentive. Remember to consult with a tax professional for personalized advice tailored to your specific circumstances. Act now and take advantage of the Tax Rebate 2023 to maximize your savings and contribute to the growth of the South Carolina economy.