Nys Property Tax Rebate 2023 – The NYS Property Tax Rebate program was established to provide financial assistance to eligible homeowners who pay high property taxes. The program provides a rebate on a portion of property taxes paid during the previous year, up to a maximum of $350.

Purpose of the Rebate

The purpose of the rebate is to help ease the financial burden on homeowners who are struggling to pay their property taxes. This program is only available to residents of New York State.

Eligibility Criteria

Homeowner Requirements

In order to be eligible for the NYS Property Tax Rebate, applicants must be homeowners who pay property taxes. Renters are not eligible for the program.

Income Limits

There are income limits for eligibility for the program. In 2023, the income limit is $500,000 for downstate counties (including New York City, Nassau, Suffolk, Rockland, Westchester, Orange, and Putnam) and $275,000 for the rest of the state.

Property Location

The property must be the primary residence of the applicant and located in New York State. Second homes or vacation homes are not eligible for the rebate.

How to Apply

Online Application

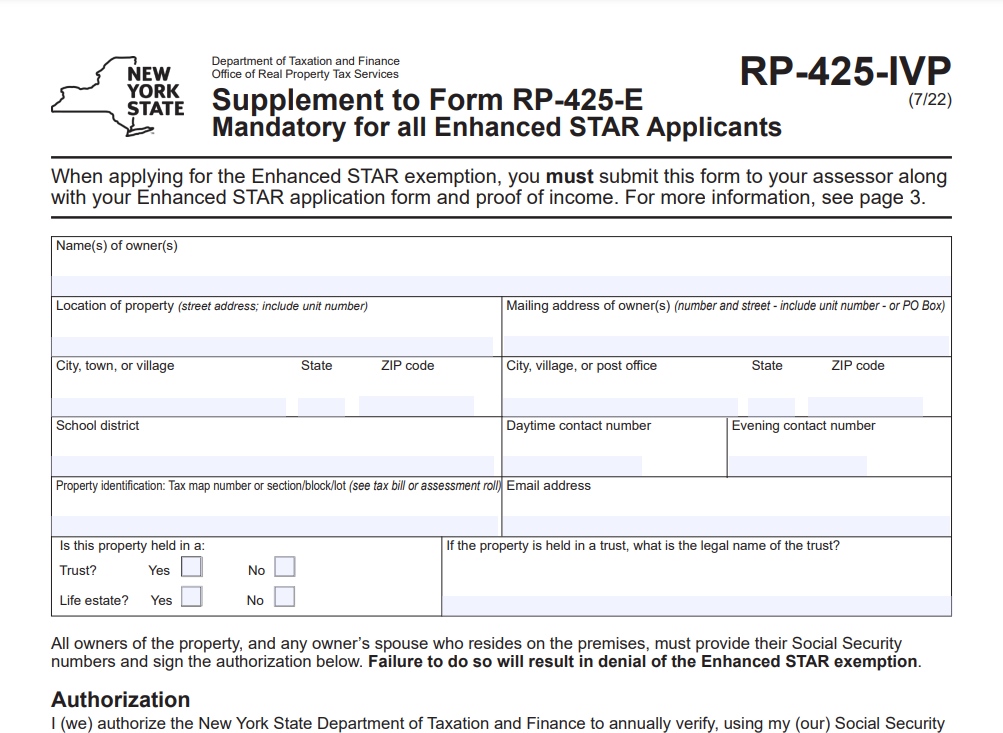

Applicants can apply for the NYS Property Tax Rebate online through the NYS Department of Taxation and Finance website. The online application process is fast and convenient, and applicants will receive an immediate confirmation once the application is submitted.

Paper Application

Alternatively, applicants can also apply by mail. Paper applications can be downloaded from the NYS Department of Taxation and Finance website or requested by calling the department’s customer service center.

Application Deadline

The deadline to apply for the NYS Property Tax Rebate is typically in the fall of each year. For the 2023 program, the deadline is December 31, 2023. It’s important to submit your application before the deadline to ensure that you are considered for the program.

Receiving the Rebate

Timing of Rebate

The timing of the rebate may vary depending on when the application was submitted and processed. However, rebates are typically issued between August and October of the year following the application.

Method of Payment

Approved applicants will receive their rebate either by check or direct deposit. If you choose to receive your rebate by direct deposit, you will need to provide your bank account information on your application.

Questions and Contact Information

If you have any questions about the NYS Property Tax Rebate program or need assistance with your application, you can contact the NYS Department of Taxation and Finance at 518-457-2036. Representatives are available to assist you Monday through Friday, from 8:30 a.m. to 4:30 p.m.

Conclusion

Recap of Important Information

To recap, the NYS Property Tax Rebate program provides financial assistance to eligible homeowners who pay high property taxes. Eligibility is based on several factors, including income, property location, and homeowner status. Applicants can apply online or by paper application, and must submit all necessary documentation and information by the application deadline. Rebates are typically issued between August and October of the year following the application.

Final Thoughts

If you’re struggling to pay your property taxes and meet the eligibility requirements for the NYS Property Tax Rebate, don’t hesitate to apply. This program is designed to help ease the financial burden on homeowners and provide much-needed financial assistance. By following the steps outlined in this guide, you’ll be on your way to receiving your rebate and getting the financial support you need.