New Jersey Property Tax Rebate 2023 – Welcome to our comprehensive guide on the New Jersey Property Tax Rebate for 2023. In this article, we will provide you with all the necessary information to understand and take full advantage of this program. As a resident of New Jersey, you have the opportunity to reduce your property tax burden through this rebate. We will delve into the details, eligibility criteria, application process, and key dates to ensure that you can make the most of this valuable benefit. So, let’s explore the New Jersey Property Tax Rebate for 2023!

What is the New Jersey Property Tax Rebate?

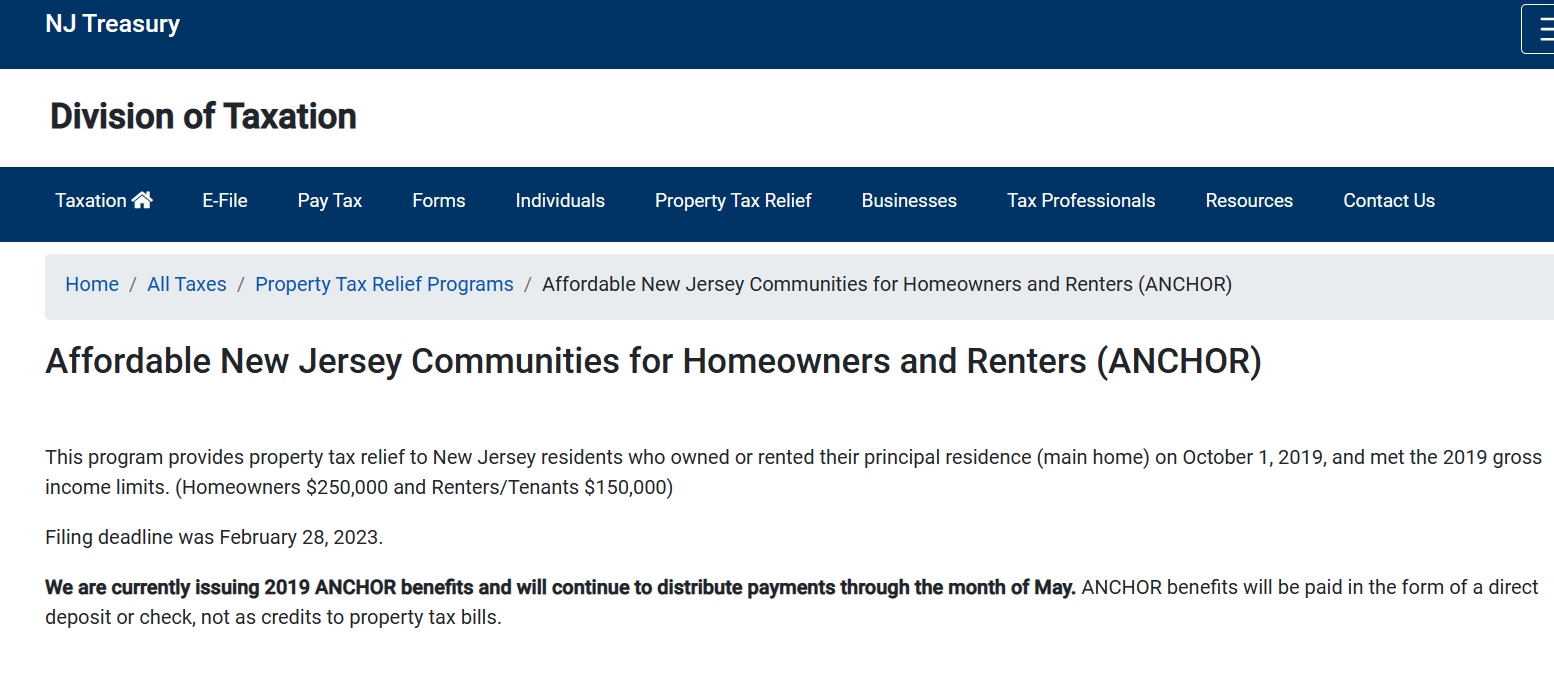

The New Jersey Property Tax Rebate is a program designed to provide financial relief to eligible homeowners in the state. The rebate is aimed at reducing the burden of property taxes, which can be a significant expense for many residents. The amount of the rebate varies depending on factors such as income, age, and disability status. By offering this rebate, the state aims to alleviate the financial strain on homeowners and promote housing affordability.

To qualify for the New Jersey Property Tax Rebate, homeowners must meet certain eligibility requirements, including being a New Jersey resident, owning a home in the state, and meeting income limitations. The rebate is available to both senior citizens and non-senior citizens, with different income thresholds for each group. The program is administered by the New Jersey Division of Taxation.

Eligibility Criteria for the New Jersey Property Tax Rebate

To determine if you qualify for the New Jersey Property Tax Rebate, it is important to understand the eligibility criteria. The program has different requirements for senior and non-senior citizens. Let’s take a closer look at each category:

For senior citizens: Senior citizens aged 65 and older are eligible for the rebate if they meet the following criteria:

- They must have been a New Jersey resident for at least one year prior to applying for the rebate.

- They must have owned and occupied a home in New Jersey as their principal residence for at least one year.

- Their annual income must fall within the specified limits set by the program.

For non-senior citizens: Non-senior citizens, under the age of 65, are eligible for the rebate if they meet the following criteria:

- They must have been a New Jersey resident for at least one year prior to applying for the rebate.

- They must have owned and occupied a home in New Jersey as their principal residence for at least one year.

- Their annual income must fall within the specified limits set by the program.

How to Apply for the New Jersey Property Tax Rebate

Applying for the New Jersey Property Tax Rebate is a relatively straightforward process. Here are the steps you need to follow:

- Gather the required documents: Before starting the application, ensure you have all the necessary documents, including proof of residency, proof of ownership, and income documentation. These may include tax returns, Social Security statements, and other relevant financial records.

- Complete the application form: The application form for the New Jersey Property Tax Rebate can be obtained from the New Jersey Division of Taxation website or by visiting a local tax office. Fill out the form accurately, providing all the requested information.

- Submit the application: Once you have completed the application form, submit it to the New Jersey Division of Taxation along with the required supporting documents. Be sure to review the application thoroughly before submission to avoid any errors or omissions.

- Await confirmation and processing: After submitting your application, the New Jersey Division of Taxation will review your eligibility and process your rebate. The processing time may vary, but you can expect to receive a notification regarding the status of your application within a reasonable timeframe.

Key Dates for the New Jersey Property Tax Rebate

To ensure you don’t miss out on the opportunity to apply for the New Jersey Property Tax Rebate, it is essential to be aware of the key dates associated with the program. While the exact dates for 2023 may vary, here are some general guidelines based on previous years:

- Application period: The application period typically opens in the early months of the year, usually around January or February. It is crucial to submit your application within the specified timeframe to be considered for the rebate.

- Deadline for applications: The deadline for submitting your application is usually around the end of June or early July. Make sure to submit your application well before the deadline to avoid any last-minute complications.

- Notification of rebate status: After processing the applications, the New Jersey Division of Taxation will notify applicants of their rebate status. This notification is typically sent out in the fall, around September or October. It is important to keep an eye out for any correspondence from the division during this period.

Conclusion

The New Jersey Property Tax Rebate for 2023 provides an excellent opportunity for homeowners to reduce their property tax burden and alleviate financial stress. By understanding the eligibility criteria, application process, and key dates associated with the program, you can maximize your benefits and make the most of this valuable rebate. Remember to gather all the necessary documents, submit your application on time, and keep track of any correspondence from the New Jersey Division of Taxation. Take advantage of the New Jersey Property Tax Rebate and lighten the load on your property taxes this year!

In conclusion, the New Jersey Property Tax Rebate is an invaluable program designed to support homeowners in the state. By providing comprehensive information on eligibility, application process, and key dates, we aim to assist you in taking full advantage of this opportunity. Act now, follow the steps outlined in this guide, and seize the benefits of the New Jersey Property Tax Rebate for 2023.