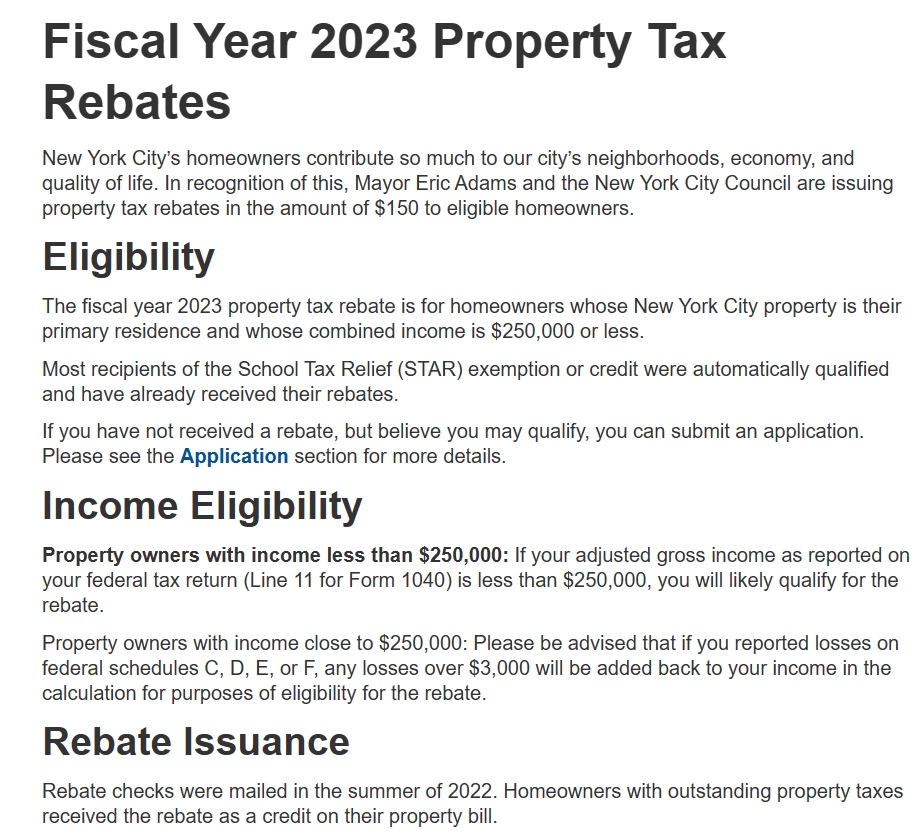

2023 Property Tax Rebate Form – The 2023 Property Tax Rebate Form is a program that provides financial relief to property owners who meet certain eligibility criteria. It allows qualified individuals to receive a rebate on their property taxes, reducing the overall amount they owe. This program is administered by the local government and is intended to provide relief to homeowners who may be struggling to pay their property taxes.

Eligibility Criteria

To be eligible for the 2023 Property Tax Rebate Form, applicants must meet certain criteria, which may vary depending on the local government. Some of the common eligibility requirements include:

- Being the owner of the property for which the rebate is being sought

- Residing in the property as a primary residence

- Meeting certain income thresholds

- Being up-to-date on property taxes and not having any outstanding debts or liens

Deadline

The deadline for submitting the 2023 Property Tax Rebate Form may vary depending on the local government, but it is typically within a specific window of time. It is important to submit the form before the deadline to be considered for the rebate. Late submissions may not be accepted.

How to Apply

- Obtain a copy of the 2023 Property Tax Rebate Form from the local government’s website or by visiting their office in person

- Fill out the form completely and accurately, including all required information and signatures

- Attach all required documents to the form, including proof of income and property ownership

- Submit the completed form and documents before the deadline via mail, email, or in person

Required Documents

To complete the 2023 Property Tax Rebate Form, you will need to gather the following documents:

- Proof of income, such as tax returns or pay stubs

- Proof of property ownership, such as a property deed or tax bill

- Any other documents required by the local government, such as residency verification or proof of hardship

Contact Information

If you have questions about the 2023 Property Tax Rebate Form or need help completing it, contact your local government’s property tax department. They can provide additional information and guidance on the program, as well as answer any questions you may have.

Conclusion

The 2023 Property Tax Rebate Form is an opportunity for eligible homeowners to receive financial relief on their property taxes. By following the eligibility criteria, submitting the form before the deadline, and providing all required documents, homeowners can potentially reduce the amount they owe on their property taxes. Don’t hesitate to apply for this program and reach out to your local government for assistance.